direct vs indirect cash flow forecasting

The direct method is less commonly used but much easier to calculate. Building a cash flow statement with the indirect method Set up the statement.

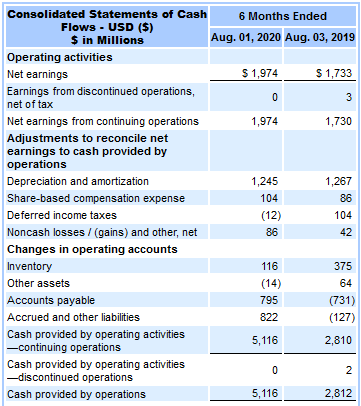

Statement Of Cash Flows Indirect Method Format Example Preparation

In fact its the only feasible way of producing a cashflow forecast manually its too difficult to model any volume transactions by hand so in the past most finance people have relied on the indirect method.

. Operating activities include revenues and operating expenses while investing activities include the sale or purchase of. Whereas the direct method will only focus on the cash transactions and produces the flow from the operations of your business. The main difference between the two methods relates to the cash flows from the operating activities.

Eventually they switch to indirect cash flow forecasting as the company expands or plans for acquisitions. Martin Gillespie 8 min read. The direct cash flow forecasting formula is exactly what you would expect.

The indirect method uses your net income as its base and comes to a figure by the use of adjustments. We begin by forecasting cash flows from operating activities before moving on to forecasting cash flows from investing and financing activities. Cash flow receivables - expenditures.

Gain control and visibility over your cash to assess the impact of decisions with Planful. The indirect method begins with your net income. As you can see this method directly uses cash inflow and outflow to generate its output.

Reason being that the direct method provides information which may be useful in estimating future cash flows of an entity which helps the users in their decision making for eg for estimating the market value of an entity for estimating the future liquidity position etc. In the case of an indirect cash flow method changes in assets and liabilities accounts are adjusted in the net income to replicate cash flows from. They both will come to the same figure but via different sets of data.

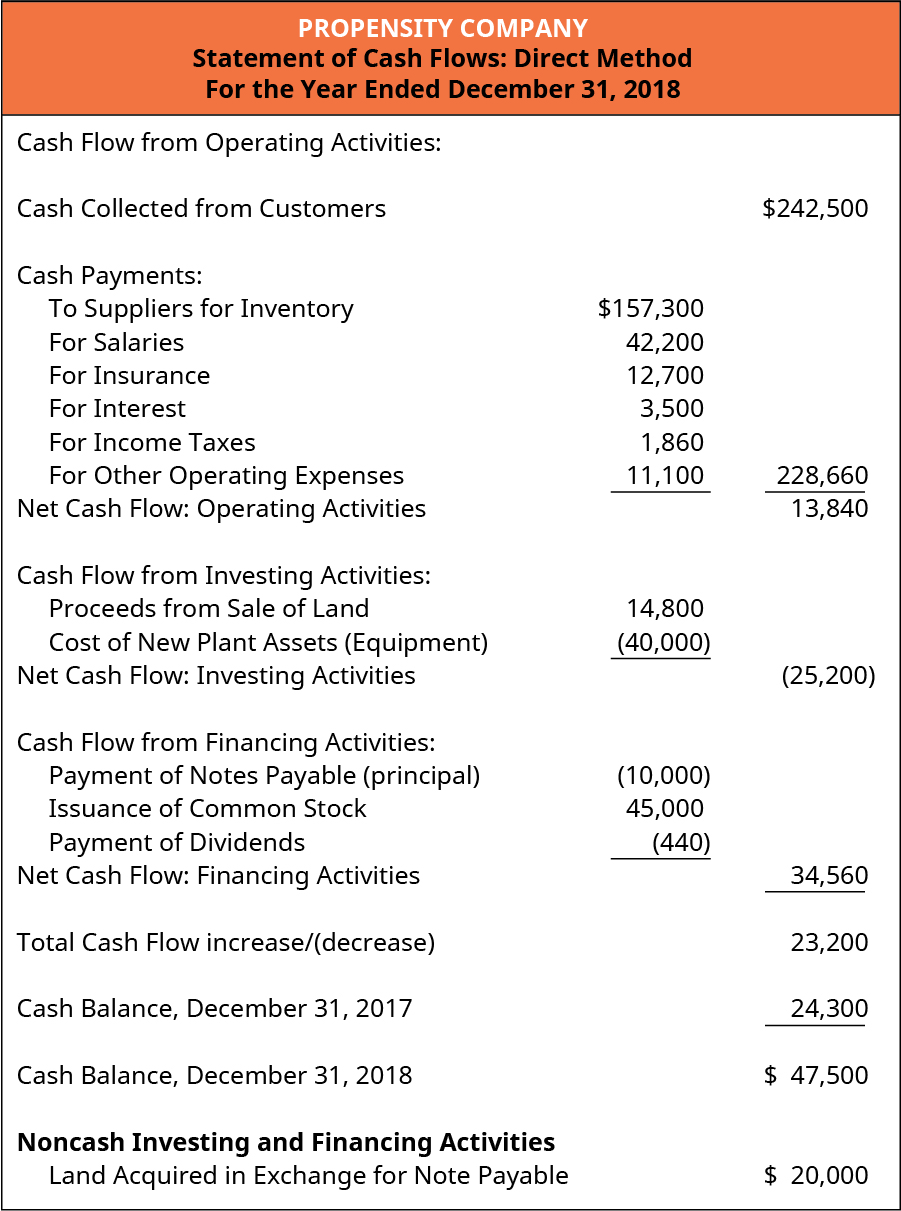

Moreover each business is different and may prefer a certain way. Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. This helps them to identify borrowing or investment opportunities.

The cash flow methods affect just the cash flow from the operating activities while the cash flow from the investment and financing sections remain the same under both methods. The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. It is a simple way of calculating your cash flow and can be done quickly from data readily available in your accounting software.

For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. Compare multiple versions of models and what-if scenarios. The near-term forecasting is known as direct forecasting while the longer-term forecasting is known as indirect forecasting.

Cash flow forecasting is the process of estimating the flow of cash in and out of a business over a specific period of time. Obviously the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods but also more informative for analyzing cash flows since it makes it possible to get a more complete picture of their amount and composition allowing to determine not only the net cash flows by type of activity but also. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements.

This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. Ad Recognize trends and adjust investment opportunities through mitigating cash flow risk. An accurate cash flow forecast helps companies predict future cash positions avoid crippling cash shortages and earn returns on any cash surpluses they may have in the most efficient manner.

In the case of direct cash flow methods changes in cash payments are reported in cash flows from the operating activities section. Generally speaking the indirect method is easier to use. The key differences between the Direct vs Indirect Cash Flow Methods are as follows.

Direct forecasting can be quite accurate while indirect forecasting yields increasingly tenuous results after not. The indirect method is widely used by many businesses. A cash flow forecast can be derived from the balance sheet and income statement.

Such information is not available under the indirect method. Alternatively the direct method begins with the cash amounts received and paid out by your business. The reason this method isnt very common is that it can become.

Forecast your future cash position and regain your control on your business finances. One of the adjustments can be regarded as the treatment of non-cash expenses. So if the direct method is so accurate why would you use the indirect method.

The indirect method is relatively complex method as compared to the direct method as it utilizes net income as the base and performs necessary cashflow adjustments. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times. As you are simply making a few adjustments to one figure you can arrive at your final figure much quicker than the direct method.

Generally companies start with direct cash flow forecasting to understand their daily cash movements. When the indirect method of presenting a corporations cash flows from operating activities is used this section of SCF will begin with a corporations net income. This then identifies your operating cash flow.

This then helps you identify your businesss net cash flow from operating activities. The direct method on the other hand describes listing all your businesss cash inflows and outflows during the defined period. Change models on the fly.

The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. The net income is then followed by the adjustments needed to convert the accrual accounting net income to the cash flows from operating activities. Reporting The primary distinction between the direct and indirect cash flow statements is that operating activities generally report cash payments and cash receipts occurring.

Eventually youll need to switch to indirect cash flow forecasting as your company expands. Ad Create driver-based plan forecasting models to align financial plans to objectives. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses.

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Standard Business Plan Financials Indirect Cash Flow Forecasting Planning Startups Stories

Direct Vs Indirect The Best Cash Flow Method Vena

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Example Indirect Method Of Cash Flow Statement Financiopedia

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

How To Create A Cash Flow Statement Using The Indirect Method

Cash Flow Projection Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintai Cash Flow Statement Cash Flow Budgeting Worksheets

How Direct Cash Flow Models Help Predict Liquidity Wsj

Direct Indirect Method Of Cash Flow Forecasting Float

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Can Quickbooks Report Cash Flows Using A Direct

Direct Vs Indirect Cash Flow Statement Excel Model 365 Financial Analyst

Appendix Prepare A Completed Statement Of Cash Flows Using The Direct Method Principles Of Accounting Volume 1 Financial Accounting

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal